October remittances jump 24% year-on-year to $3.05bn

Overseas workers’ remittances swelled 23.9% to $3.1 billion in October 2024 from $2.46 billion recorded in the same month last year, data released by the State Bank of Pakistan (SBP) showed on Friday.

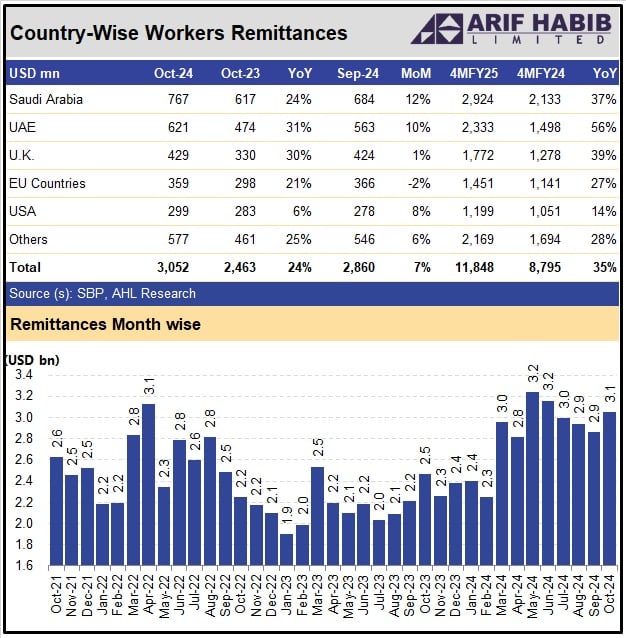

Remittances were up 6.7% from $2.86 billion in September 2024 month-on-month. Cumulatively, in the first four months of the fiscal year (4MFY25), inflows surged nearly 34.7% year-on-year to $11.8 billion, up from $8.8 billion in the same period of FY24.

Analysts attribute the increase to a stable exchange rate, a narrower gap between open and inter-bank rates, growth in digital payment channels, and more workers relocating overseas.

A breakdown shows that in October 2024, Saudi Arabia was the largest contributor, with Overseas Pakistanis sending $766.7 million, marking a 12% increase from September and a 24% rise from $616.8 million in October 2023.

Inflows from the UAE rose 10% month-on-month, from $562.7 million in September to $620.9 million in October, and jumped 31% year-on-year compared to $473.9 million last October.

Remittances from the UK reached $429.5 million, a slight 1% increase from September’s $424.1 million and a 30% year-on-year rise.

The European Union saw a 2% drop in inflows, totalling $359.1 million in October compared to $365.5 million in September. Meanwhile, remittances from the US rose 8% month-on-month, reaching $299.3 million in October.

In a bid to further boost remittances, the State Bank of Pakistan (SBP) recently revised its incentive structure for banks and exchange companies, introducing both fixed and variable components to encourage higher inflows.

Remittances, which were lacklustre during 2023 due to domestic uncertainty and the disparity between official and unofficial exchange rates, have begun to recover, The News reported.

These inflows have been on the rise, with a strong rebound since March 2024, reaching an average of $3 billion per month and hitting a high of $3.2 billion in May. Healthy remittances have become crucial for Pakistan’s economy, especially given the country’s sluggish export performance.

Remittances are an important source of foreign exchange reserves for the country. A report from Insight Securities highlighted the steady growth in remittances over the last 20 years, which has helped offset the impact of the growing trade deficit and supported the balance of payments.

The increase in remittances provides livelihoods for many households and also supports domestic consumption, thereby fuelling various sectors of the economy.

Pakistan had been faced its worst economic crisis, witnessed highest-ever inflation and was on the brink of a sovereign default last summer before receiving a $3 billion bailout from the International Monetary Fund (IMF).

The successful conclusion of the nine-month IMF’s stand-by arrangement in April provided macroeconomic stability. Since then, inflation has eased, and credit ratings agency Moody’s has upgraded Pakistan’s local and foreign currency issuer and senior unsecured debt ratings to ‘Caa2’ from ‘Caa3’, citing improving macroeconomic conditions and moderately better government liquidity and external positions.

The implementation of the new larger and longer IMF loan programme is expected to ensure lasting macroeconomic stability. The current account deficit has remained under control due to an increase in foreign exchange reserves supported by strong remittances and improvement in exports.

Following the receipt of the $1.03 billion first tranche of the $7 billion loan from the IMF, the central bank’s forex reserves increased to $10.7 billion as of September 27, enough to fund more than two months of imports.