PSX blasts to new highs above 103,000

Stocks on Monday blasted off to new highs, bolstered by strong fundamentals and sectoral performances, amid hopes that a steady fall in inflation could lead to a larger-than-expected cut in policy rates, boosting economic activity in the country and shifting bond investors toward equities.

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index on Monday surged by 1,917.62 points or 1.89% to reach a new high of 103,274.94, compared to the previous close of 101,357.32, as the market continues to capitalise on the rally that saw it cross the 100,000 milestone last week.

“The positive momentum observed since last week and even earlier continues, supported by improving macroeconomic factors,” said Sana Tawfik, Head of Research at Arif Habib Limited.

“With inflation expected to hit its lowest level since April 2018, we expect it to be around 4.7%, and improved market liquidity, all factors are boosting the market’s performance,” she added.

One of the developments bolstering market sentiment was the receipt of $500 million from the Asian Development Bank (ADB) as part of the Climate Change and Disaster Resilience Enhancement Program.

This inflow has strengthened Pakistan’s foreign exchange reserves, pushing them close to the $12 billion mark. Analysts view this as a pivotal factor in reducing economic uncertainty and enhancing investor optimism.

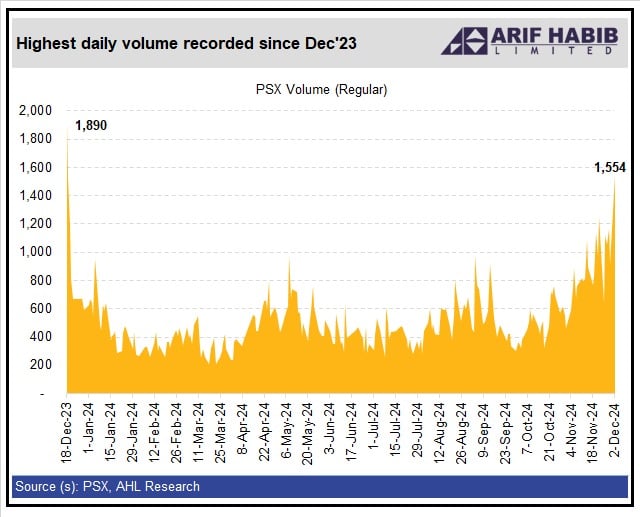

Arif Habib Limited (AHL) in a report said the daily traded volume increased by 70% day-on-day to 1.554 billion shares — the highest since December 18, 2023, when 1.89 billion shares were traded on PSX.

Sectoral performance has been key to the index’s climb, with commercial banks leading the charge by contributing 1,675 points last week.

The removal of the Minimum Deposit Rate (MDR) requirement for corporate deposits further buoyed the banking sector, which has continued to attract substantial investor interest.

Technology and communication, oil and gas exploration, and property sectors also posted robust gains last week, reflecting broader market participation.

“Consistent decline in yields and movement of investors from fixed income to equities is pumping the market,” noted Samiullah Tariq, Head of Research at Pak-Kuwait Investment Company.

Market analysts credit the rally to the government’s decisive economic reforms and a brighter inflation outlook, with projections suggesting inflation could drop to 5.6%-6.5% by December.

This development has raised expectations that it could lead to a further interest rate cut by the State Bank of Pakistan (SBP), bolstering investors’ confidence.

Lower inflation expectations, coupled with a significant interest rate cut by the SBP earlier in November, have created a favourable environment for equity markets.

The average daily traded value on the ready counter rose by 7.1% week-on-week, reaching Rs 36.85 billion, while foreign investors withdrew $15.1 million, countered by strong buying from local insurance companies.

Today’s rise follows the index surpassing the unprecedented 100,000-point mark last week, closing at its then-highest level of 101,357.32 on Friday.

The outgoing week saw the market surge by 3,559.09 points on a weekly basis, driven by a combination of local investor enthusiasm and institutional support.

Despite dips, the market recovered strongly, showcasing resilience amidst political volatility and a favourable regulatory environment.

As the PSX continues to push into uncharted territory, the outlook remains optimistic.

Analysts believe that consistent policy support, stabilised external accounts, and reduced costs of doing business will sustain the market’s upward trajectory.